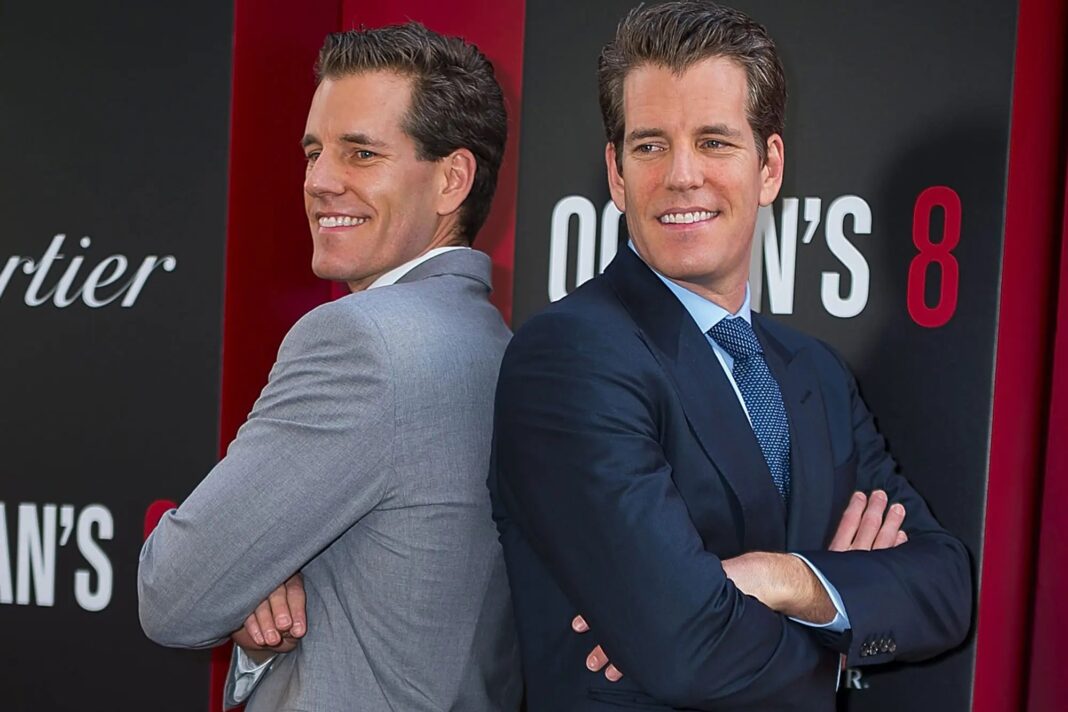

Cameron Winklevoss, co-founder of the cryptocurrency exchange Gemini, announced that the US Securities and Exchange Commission (SEC) has officially closed its investigation into the company without pursuing any enforcement action.

SEC Closes Gemini Investigation

In his social media post, Winklevoss revealed that the SEC’s letter, dated February 24, stated that the agency’s staff “do not recommend an enforcement action by the Commission” against Gemini.

The investigation, which began 699 days ago, included a Wells Notice issued 277 days prior, warning the company of potential legal action.

Winklevoss expressed relief over the SEC’s decision but lamented the extensive costs incurred during the investigation, estimating that it drained “tens of millions of dollars in legal bills alone” from the company.

However, while he welcomed the closure of the investigation, Winklevoss criticized the SEC for what he described as “bully, harass, and attack” tactics against a lawful industry. He emphasized the broader implications of the SEC’s actions, suggesting they stifled innovation and productivity within the cryptocurrency sector.

Winklevoss Urges Reform

The SEC’s recent actions reflect a shift in its approach to the cryptocurrency market. In addition to closing the investigation into Gemini, the agency has also chosen to dismiss charges against Coinbase Global Inc. and terminated its inquiry into the decentralized finance (DeFi) platform Uniswap.

This trend suggests a potential easing of regulatory pressure on the crypto sector, a development that may be influenced by the changing political landscape, including promises from President Donald Trump to introduce more favorable regulations.

Winklevoss’s post also called for significant reform within the SEC to prevent similar situations from occurring in the future. He proposed that if an agency opens an investigation without clear rules, it should reimburse affected parties for three times their legal expenses.

Gemini’s co-founder also advocated for the immediate termination of individuals involved in enforcement actions deemed unjust, suggesting their names and actions should be publicly disclosed on the SEC’s website.

Winklevoss concluded his statement by expressing hope for the future of the cryptocurrency industry, emphasizing that while this marks a crucial victory, it is only the beginning of a larger fight for fairness and accountability in the regulatory landscape.

Featured image from Page Six, chart from TradingView.com