Bitcoin experienced its biggest price drop in recent days, finally breaking out of the price compression that had been building since early February. After weeks of sideways trading and uncertainty, BTC lost weekly support around the $90K level, sending shockwaves through the market. This drop has fueled speculation about a potential bear market, with investors fearing further downside.

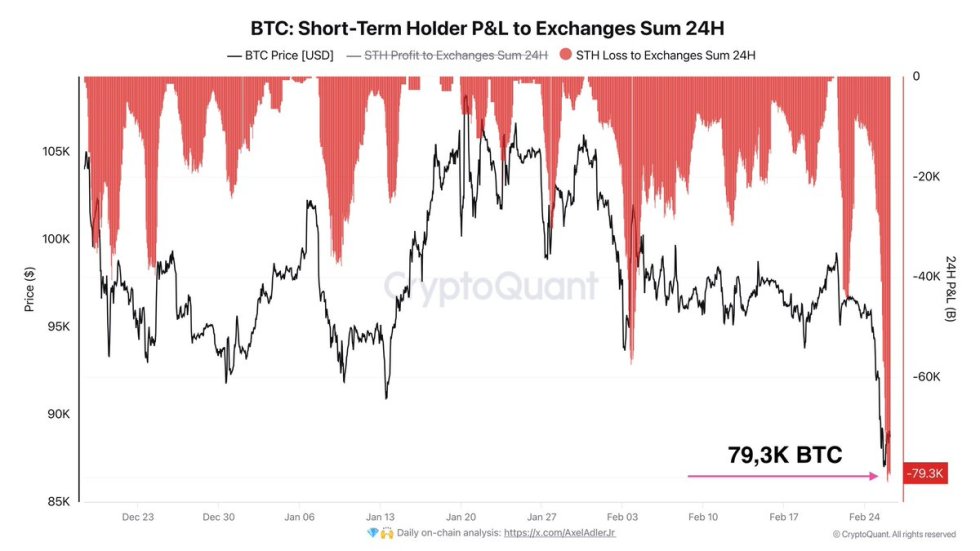

Market sentiment is turning increasingly bearish as selling pressure accelerates. CryptoQuant analyst Axel Adler shared key on-chain data revealing that in the last 24 hours, 79.3K BTC were sold at a loss on exchanges. This is a clear sign of panic selling, with short-term holders capitulating as prices decline.

Despite the negative outlook, analysts remain divided on whether this is just a short-term correction or the beginning of a longer bearish phase. The next few days will be crucial as BTC attempts to find strong support and determine its next major move. Will bulls step in to defend key levels, or is Bitcoin set for an even deeper decline? All eyes are now on BTC’s ability to reclaim lost ground.

Bitcoin Faces Heavy Sell-Off

Bitcoin is trading below its mid-November highs, which were set post-election when President Trump’s victory was announced. Since then, BTC has been on a steady decline, and now, fear has taken over the market as prices keep retracing. Speculation about a potential bear market is growing, with many investors worried that Bitcoin’s bull run could be coming to an end.

Analysts and traders remain cautious as BTC attempts to reclaim key levels and reverse the bearish trend that has defined price action in recent weeks. So far, Bitcoin has struggled to find strong support, making investors anxious about whether further declines are coming.

To add to this uncertainty, Adler’s data reveals that the 79.3K BTC sold at a loss on exchanges in the last 24 hours marks the largest Bitcoin sell-off of 2025, highlighting the level of panic among short-term holders. Historically, sell-offs of this magnitude can signal one of two things: either a market bottom is forming as weak hands capitulate, or it marks the start of a deeper bearish phase.

The next few trading sessions will be crucial as Bitcoin fights to regain key support levels. If BTC fails to recover soon, the market may be in for a prolonged bearish trend.

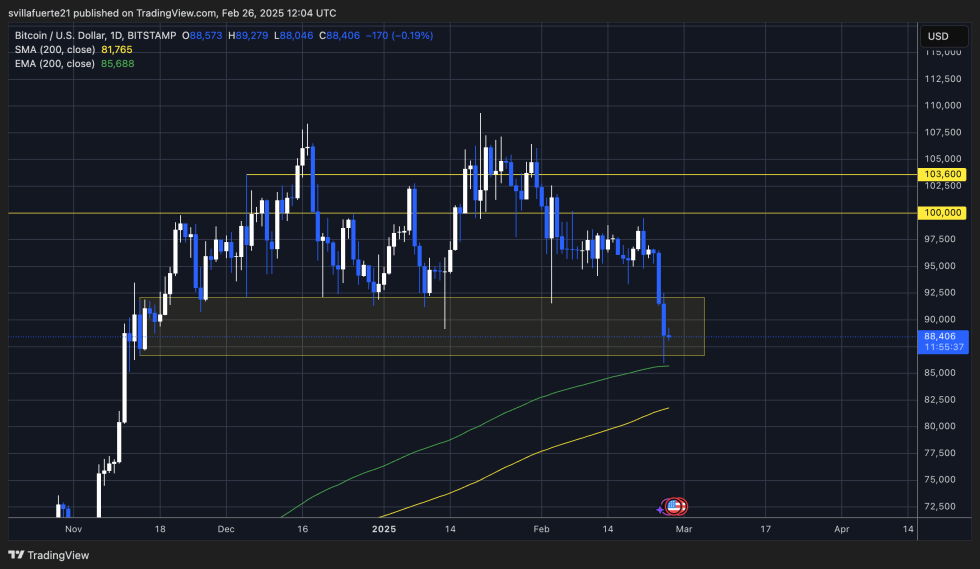

Price Drops Below $90K

Bitcoin is trading at $88,400 after enduring days of massive selling pressure, with the price plummeting below key demand levels. BTC recently tagged the 200-day exponential moving average (EMA), a critical indicator of long-term market strength. This level typically acts as a strong support zone, but if BTC fails to hold, it could signal further downside.

Bulls now face a crucial test—they must reclaim the $90K level and push above $95K to confirm a recovery rally. Breaking above these levels would shift the momentum back in favor of the bulls and could trigger a renewed push toward $100K.

However, if BTC loses its current support zone, it could lead to a deeper correction, potentially sending the price into lower demand areas. Investors and analysts are closely watching whether Bitcoin can stabilize at these levels or if another wave of selling pressure will drive prices even lower.

With market sentiment leaning bearish, Bitcoin needs a strong bounce soon to avoid further downside risk. The coming days will be critical, as a failure to hold the 200-day EMA could confirm a more extended bearish phase for BTC.

Featured image from Dall-E, chart from TradingView