Jerome Powell is making it clear—there will be no digital dollar or US central backed digital currency (CBDC) under his leadership.

Testifying before the Senate Banking Committee on February 11, Powell stressed that no digital dollar is in the works and confirmed that congressional approval would be mandatory for such a move.

Powell was pressed by Senator Bernie Moreno (R-OH) for a commitment to block a CBDC, but Powell didn’t mince words. His one-word answer—“Yes”—left no room for debate.

We Already Have a Digital Dollar, WTF Is Powell On About?

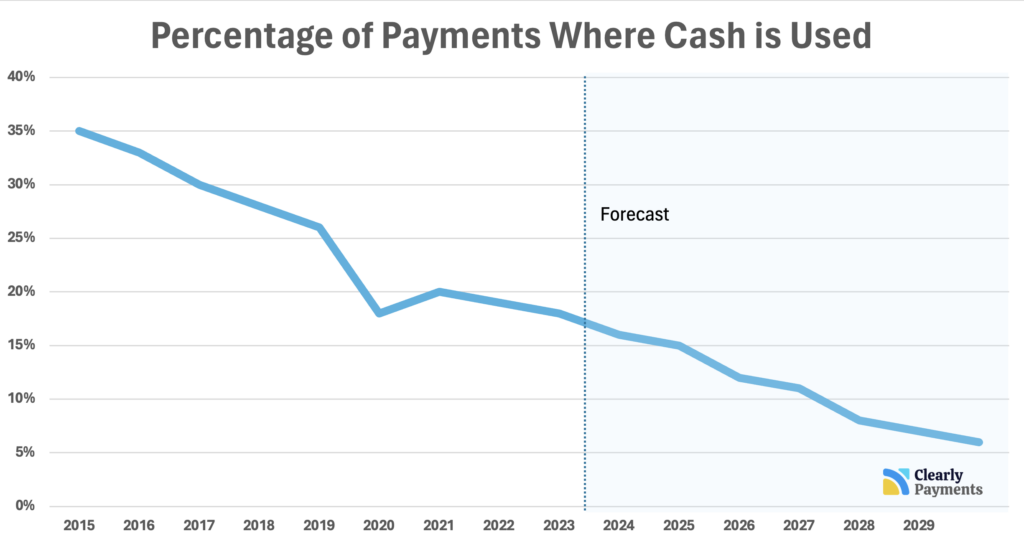

Despite Powell’s remarks, a move toward CBDCS is happening, and 99.9% of people are sleepwalking through it without batting an eye.

The move to a CBDC is happening via stablecoins, especially as they are backed by anything and everything.

Currently, we see stablecoins backed by gold or other hard assets, but El Salvador could pin its mega prison production to its stablecoin or China to rare earth mineral exports. It’ll continue until everyone stops using Monopoly money. The system has already been gamed out; therefore, we’re seeing a push for a paradigm they can exploit.

People online are touting victory, with government entities like US Republicans and Jerome Powell stating they’ll never create CBDC. These people don’t realize that CBDC already exists in the form of stablecoins.

People do not read because they would not understand perception management if they did.

We are so cooked it’s not even funny

Legislative Pushbacks Against CBDCs

Thankfully, anti-CBDC forces in Congress are stepping up the fight. The No CBDC Act, filed in both the House and Senate, seeks to block the Federal Reserve from issuing a digital dollar without lawmakers’ blessing.

Backers argue such a currency could shatter financial privacy and give the government unchecked power to surveil citizens.

Congressman Tom Emmer, sponsor of the Anti-Surveillance State Act, didn’t mince words. “A U.S. CBDC could allow the federal government to monitor and control individual Americans’ spending habits,” he said. Opponents point to China’s digital yuan as a cautionary tale, a tool critics argue allows for financial overreach and eroded freedoms.

Global Momentum in CBDC Development: Will Stablecoins Win?

The U.S. may hesitate, but the world is moving full speed ahead on CBDCs. According to the Atlantic Council, 134 countries—covering 98% of the global economy—are exploring digital currencies. Of those, 66 are running advanced pilots or fully deploying CBDCs.

China’s digital yuan is taking center stage with expanded trials in major cities, showing how governments could remake financial systems. Europe is ramping up efforts with its digital euro, and powerhouses like India, Brazil, and Russia are no strangers to CBDC development.

The U.S. remains focused on fostering blockchain without venturing into CBDC territory. But we’ll see if the CBDC project becomes a trojan horse shipped via stablecoins. It seems likely.

EXPLORE: Dogecoin Decoupling From Bitcoin Price? As Market Dips Investors Flock to Dogeverse

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Fed Chair LIES And Says “No” to Digital Dollar During His Tenure appeared first on 99Bitcoins.