South Dakota Representative Logan Manhart declared on February 4 that his state may soon become the first in the nation to pass a strategic Bitcoin reserve (SBR) bill, citing South Dakota’s notably short legislative session and an imminent deadline in mid-March. “South Dakota has one of the shortest legislative sessions in the country. It is likely South Dakota will be the first state in the nation to pass a Bitcoin reserve bill,” Manhart posted on X.

A user questioned whether the legislature was still in session, referencing a common misconception that it ended in January. Manhart clarified, “Yes it goes until the 2nd week of March. 40 legislative days.”

Will South Dakota Be The First Bitcoin State?

The drive to establish a strategic Bitcoin reserve in South Dakota came to light when Manhart first revealed, on January 28, “I am proud to say I will be bringing a bill in the South Dakota House that would create a strategic bitcoin reserve. Now is one of the few chances government has at being proactive. Let’s have this conversation!”

House Bill 1202, introduced on January 30, is the vehicle for that initiative. The legislation, introduced by Manhart as the prime sponsor and supported by Representatives Aaron Aylward, Phil Jensen, and Dylan C. Jordan, as well as Senator Carl Perry, would permit the State Investment Council to allocate up to 10% of state funds into Bitcoin.

The bill outlines that custody of any acquired BTC must be arranged either through a secure custody solution overseen by the state itself, by a qualified custodian, or via an exchange-traded product approved by federal regulators. It further details stringent requirements for the safekeeping of the private keys, including multi-party governance, encrypted storage, and thorough disaster recovery planning.

The proposed measure saw its first reading in the House on February 3, after which it was sent to House State Affairs for further consideration.

Manhart’s comments appear against a backdrop of intensifying competition among multiple US states to become the first to establish a SBR. Although a number of states have introduced or entertained legislation designed to create such reserves, South Dakota and Utah have recently taken center stage in discussions about which might cross the finish line first.

By popular demand: ‘SBR’ view by default.

Click the toggle to view all Bitcoin bills nationwide! https://t.co/4KnyXyqv0z pic.twitter.com/HwVPPyLv8a

— Bitcoin Laws (@Bitcoin_Laws) February 4, 2025

According to the website bitcoinlaws.io, 14 states have already introduced legislation to form an SBR. Utah, which became the 11th state to do so on January 20 under the leadership of Representative Jordan Teuscher, has only 45 days in its legislative session to approve or reject its proposal.

Dennis Porter, CEO of Satoshi Action Fund, has argued that Utah’s compressed timeline, coupled with robust political backing, makes it a prime contender to pass its bill before any other state. “It’s either sink or swim in 45 days; no other state has a faster calendar, and no one else has the political momentum and willpower to get it done,” Porter said earlier this week.

While states such as South Dakota and Utah are working on legislative measures within their short sessions, federal discussions about Bitcoin reserves have also begun to take shape.

On February 4, during a press conference on digital assets jointly hosted by White House, Senate, and House leadership for the first time, Trump’s Crypto Czar David Sacks revealed that a federal-level exploration of a Bitcoin reserve is underway. “We’re evaluating a Bitcoin reserve. One of the first things we’re going to look at in the admin. Concept of Sovereign Wealth Fund is separate,” he said.

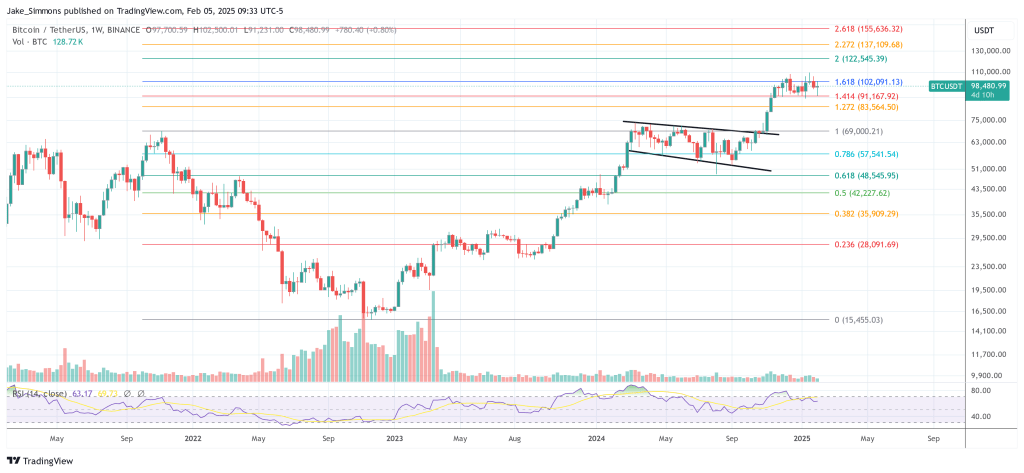

At press time, Bitcoin traded at $98,480.

Featured image created with DALL.E, chart from TradingView.com