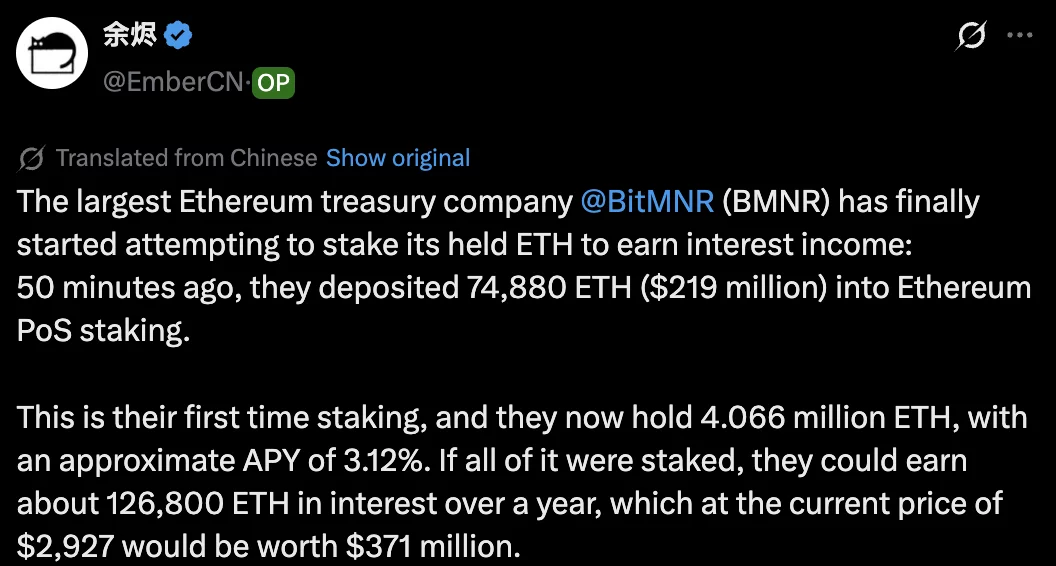

Bitmine deposited 74,880 ETH worth approximately $219 million into Ethereum’s Proof-of-Stake protocol, marking the company’s first staking operation.

The move comes as the largest Ethereum (ETH) treasury company seeks yield generation from its 4.066 million ETH holdings.

According to EmberCN monitoring, the deposit occurred on December 27. At an estimated 3.12% annual percentage yield, staking the entire treasury would generate roughly 126,800 ETH per year.

Based on Ethereum’s current price, the annual staking rewards would be worth approximately $371 million.

First staking deployment from 4M+ Ethereum treasury

The 74,880 ETH deposit is Bitmine’s initial entry into generating staking income from its holdings. The company accumulated its Ethereum position through systematic acquisitions similar to Strategy’s Bitcoin buying program.

Bitmine’s decision to stake suggests the company expects to hold Ethereum long-term rather than actively trade the position.

Staked ETH can be withdrawn but requires a queue period that varies based on network conditions. The lock-up period makes staking unsuitable for treasury assets that might need rapid liquidation.

The $219 million initial deployment tests the staking infrastructure before potentially committing the full treasury.

At 4.066 million ETH, Bitmine holds roughly $11.9 billion worth of Ethereum at current prices. Full staking would generate over 126,000 ETH annually in passive income.

Lee targets $7K-$9K Ethereum in early 2026

Bitmine Chairman Tom Lee told CNBC that Ethereum could reach $7,000 to $9,000 in early 2026. Speaking on December 26, Lee said the outlook for crypto “is still really good for the next five to ten years.”

“Wall Street wants to tokenize everything, you know, whether that’s Vlad at Robin Hood or Larry Fink at BlackRock and that’s gonna bring a lot of efficiencies,” Lee stated. “But it really brings the use case forward for something like Ethereum.”

Lee pointed to tokenization as Ethereum’s primary growth driver. Over time, as Ethereum competes with traditional payment rails, the token could reach $20,000, he predicted.

The chairman addressed crypto’s October 10 reversal, calling it “a liquidation event that was similar to 2022 when FTX collapsed.” Markets required eight weeks to recover and find their footing, Lee explained. “I think that’s what’s happening now,” he said.

Lee also discussed Bitcoin, saying the asset suffers from “gold envy” as gold reaches $30 trillion in value.