In crypto games, we are familiar with a player-versus-player (PvP) mode. But did you know that this game mechanic is now also being used in liquid pools, generating up to 150,000% annual percentage rate (APR)?

Additionally, liquidity providers on this PvP-driven platform have a chance to earn Sonic blockchain’s $S through an airdrop.

Meet Shadow Exchange

Shadow Exchange (https://www.shadow.so/) is a concentrated liquidity layer and exchange built on the Sonic network.

“With sub-second block times and instant finality, Shadow delivers an ultra-responsive trading experience on par with Sonic’s speed. Liquidity providers can adjust positions rapidly to capture opportunities, while traders enjoy near-zero slippage on Shadow.”

Shadow Exchange

According to the Sonic-based decentralized application (dApp), Shadow Exchange is built on top of the blockchain to take advantage of its FeeM, which returns 90% of the gas spent to improve user experience through dynamic fees and arbitrage.

How it Works

Compared to other staking platforms, Shadow Exchange boasts a more fluid and accessible incentive model due to its technology called x(3,3).

x(3,3) is a mechanism inspired by another technology, ve(3,3), which helps exchanges by creating a system where all participants are incentivized to act in the best interest of both each other and the exchange.

ve(3,3) introduced two key concepts that aligned exchanges with participants:

- Rebasing locked positions to prevent users from being diluted by emissions, allowing token holders to maintain the same ownership without having to buy and lock more tokens.

- Vote escrow, which fundamentally changed governance and on-chain voting by introducing time-weighted voting.

To address this, Shadow Exchange introduced an exit mechanism to ve(3,3), calling it x(3,3). This system includes an in-app token called $xSHADOW.

The development team believes $xSHADOW solves the sustainability challenges associated with earlier ve(3,3) models by combining the best of vote-escrow models with the flexibility of traditional escrow incentive systems.

Essentially, $xSHADOW is used within a PvP rebase mechanism, where exit penalties are distributed to $xSHADOW stakers.

Through this system, users can exit their $xSHADOW position at any time. However, if they exit early, 100% of the forfeited tokens are redistributed to other $xSHADOW stakers in proportion to their holdings.

According to Shadow Exchange, this structure creates powerful incentives:

- Rewards scale with the protocol, encouraging users to stay rather than locking their tokens.

- No need for locks or wrappers.

More Than Just an Initiative

Shadow Exchange’s development team emphasized its commitment to the ecosystem’s health by distributing all emissions through $xSHADOW.

Emissions can be claimed as:

- $SHADOW (Liquid): Instantly converts xSHADOW rewards to SHADOW but with the default APR.

- $xSHADOW (Illiquid): Claims emissions as xSHADOW, offering double the APR.

“This dual incentive structure ensures that participation becomes increasingly valuable over time. As more users interact with the protocol, both the frequency of exits and the volume of emissions grow proportionally, scaling Shadow without requiring artificial lock-ups or arbitrary restrictions.”

Shadow Exchange

To Clarify:

- $SHADOW is Shadow Exchange’s native on-chain token.

- $xSHADOW is an in-app token, functioning as a liquid representation of $SHADOW.

- $xSHADOW is non-transferable and represents one unit of $SHADOW held in escrow within the $xSHADOW smart contract.

- Users can acquire $xSHADOW through vote incentives, token emissions, or by converting $SHADOW at a 1:1 ratio.

- For reverse conversions of $xSHADOW to $SHADOW, the ratio is 2:1 unless the user opts for a full six-month vesting period.

The Numbers

As of March 17, 2025

Shadow Exchange has:

- $74.5 Million Total Value Locked

- $3.43 Billion Monthly Volume

- $3.04 Million Weekly Incentives

- $13.44 Million Total Rebase

- 3,632 Available Liquidity Pools

- $1.0 Million 7D Fees

- $428.95 Million 7D Volume

Meanwhile, $SHADOW has:

- ₱4,459.50 – ₱4,876.78 24-Hour Price Range

- ₱12,492.70 All-Time High Record, on February 21, 2025

- ₱365.90 All-Time Low Record, on January 28, 2025

- ₱1.30 Billion Market Cap

How to Be a Liquidity Provider on Shadow Exchange

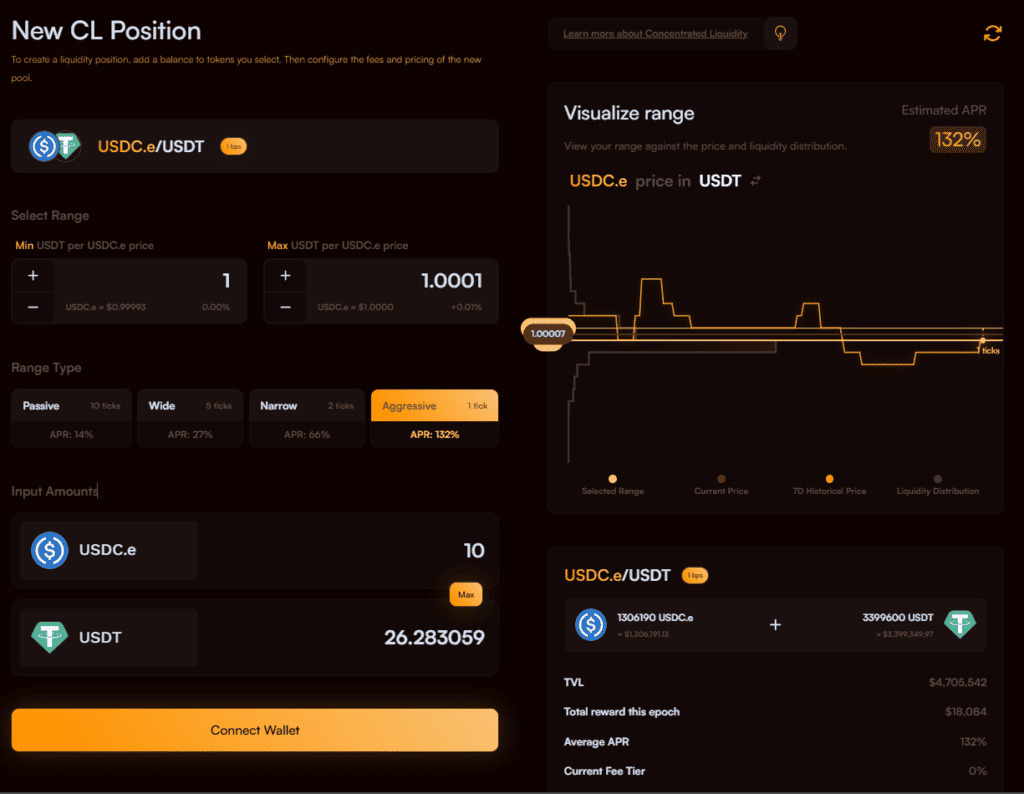

- Step 1: Go to https://www.shadow.so/liquidity.

- Step 2: Connect a wallet. Supported wallets are MetaMask, Rabby Wallet, WalletConnect, and Coinbase Wallet.

- Step 3: Choose a liquidity pool.

- Step 4: Choose the Range Type, or type of aggressiveness. The more aggressive, the higher the APR.

- Step 5: Input the amount of assets to be provided.

- Step 6: Confirm the transaction.

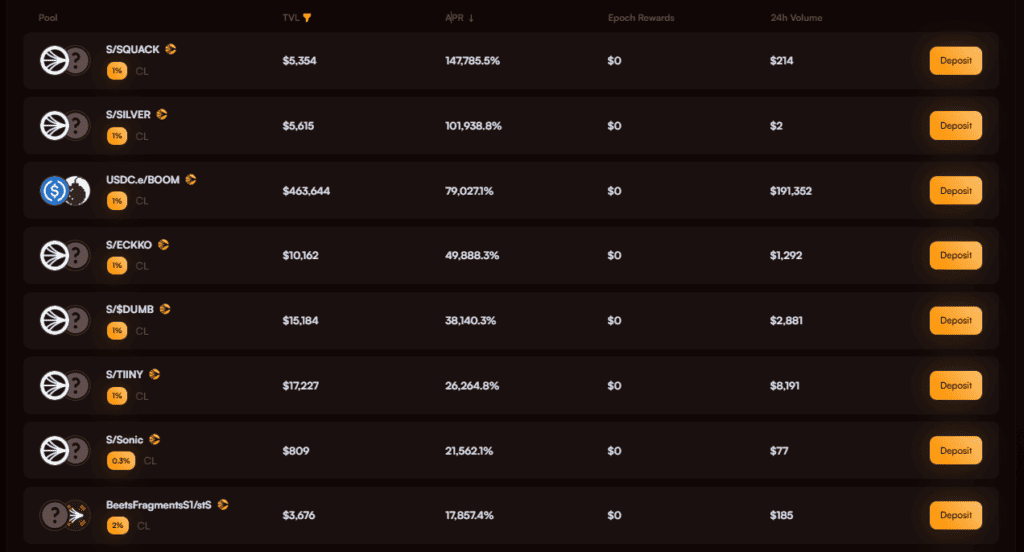

Top 5 Liquidity Pools With the Highest APR

S/SQUACK:

- Trading Volume: $5,359

- APR: 147,493.4%

S/SILVER:

- Trading Volume: $5,623

- APR: 101,734.4%

USDC.e/BOOM:

- Trading Volume: $463,644

- APR: 79,027.1%

S/ECKKO:

- Trading Volume: $10,178

- APR: 49,789.1%

S/$DUMB:

- Trading Volume: $15,210

- APR: 38,064.7%

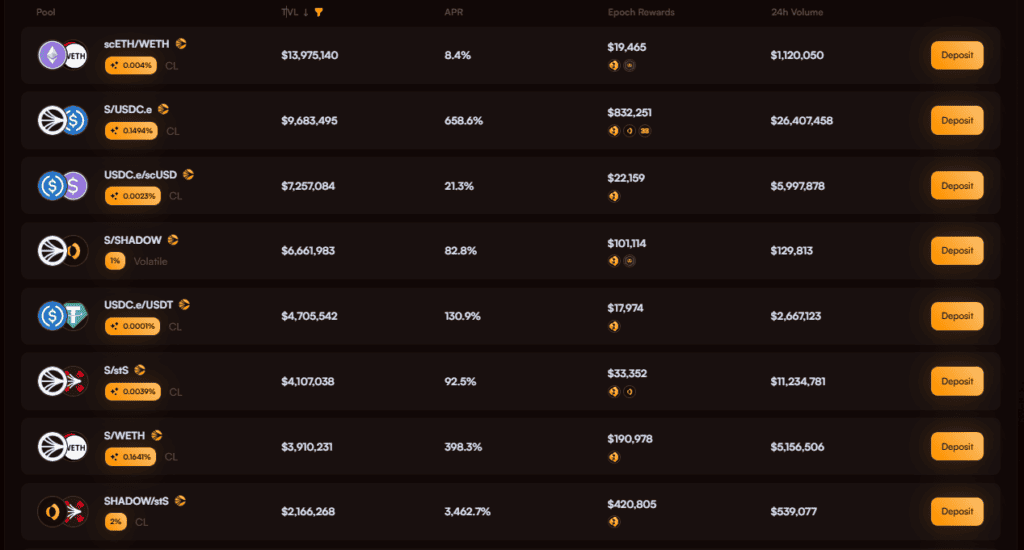

Top 5 Liquidity Pools With the Highest TVL

scETH/WETH:

- Trading Volume: $14,016,645

- APR: 8.4%

S/USDC.e:

- Trading Volume: $9,500,234

- APR: 855.7%

USDC.e/scUSD:

- Trading Volume: $7,206,721

- APR: 21.6%

S/SHADOW:

- Trading Volume: $6,674,375

- APR: 82.7%

USDC.e/USDT:

- Trading Volume: $4,705,542

- APR: 131.3%

About the $S Airdrop

In BitPinas’ Sonic Blockchain Airdrop Guide, it is clear that there are three primary ways to earn $S airdrop rewards:

- Passive Points

- Activity Points

- App Points (a.k.a. Gems)

App Points are earned by using dApps within the Sonic ecosystem that have points campaigns. When Sonic airdrops $S rewards to a dApp, that dApp then distributes those rewards to its users.

Shadow Exchange is one of the dApps where users can farm App Points.

Screenshot from: https://my.soniclabs.com/apps?pointsOnly=true

Thus, being a liquidity provider on Shadow Exchange increases the chances of earning $S airdrop rewards.

This article is published on BitPinas: How to Earn High APR & Airdrops on Shadow Exchange’s Liquidity Pools

What else is happening in Crypto Philippines and beyond?