Bitcoin’s price tumbled 11% over the weekend following Trump’s executive order to use seized BTC for reserves, while broader macroeconomic pressures and bearish technical signals point to further downside.

On March 7, Donald Trump signed an executive order to use Bitcoin (BTC) seized from criminal cases for the strategic reserve rather than buying it from the market. The announcement triggered a drop in Bitcoin’s price, which opened strong at $90,000 on March 7 but has shaved around 11% of its value over the weekend, closing at just $80,751 on March 9, according to CoinGecko. However, it has since recovered to over $82,000, currently trading for $82,154, down by 4% over the past 24 hours.

This market reaction was likely due to unrealistic expectations as many expected the government would buy BTC, injecting more money in the market. That being said, the order didn’t completely rule out future Bitcoin purchases, but they would need to be “budget-neutral,” without burden to tax payers.

Beyond the reserve-related disappointments, the Bitcoin price continues to be pressured by macro concerns, mainly related to tariffs. Specifically, the trade war between the U.S. and China is intensifying, with Beijing imposing tariffs on certain U.S. agricultural goods as a retaliation to Trump’s recent increase in Chinese import duties. Additionally, Federal Reserve Chairman Jerome Powell confirmed on Friday that the central bank will keep a wait-and-see approach to interest rates. This came after a weak U.S. nonfarm payrolls report and expectations of at least three Fed rate cuts this year.

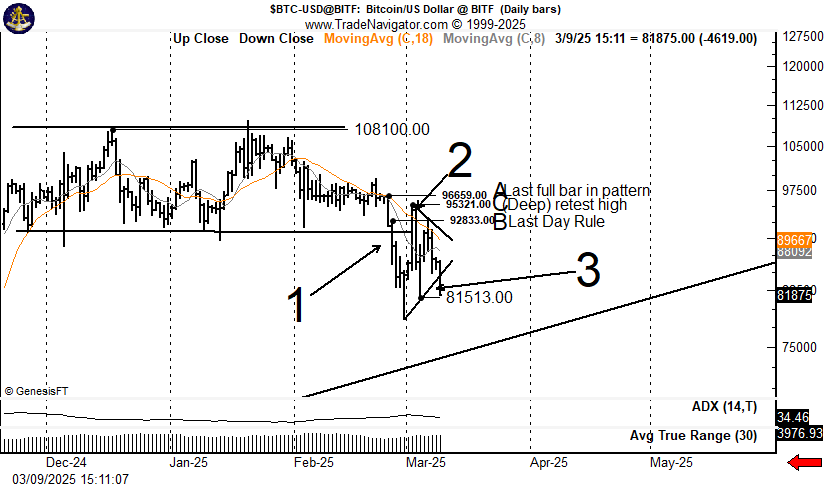

On the technical side, chart analyst Peter Brandt highlighted that the Bitcoin price completed a double top pattern, with peaks at around $108,100. After peaking, it broke down below key support (previous range) near 95,321–96,659. After the breakdown, the price formed a bearish pennant (a consolidation pattern), which retested the breakdown zone around 95,321–96,659) but failed to reclaim it. The pennant has completed, and price broke lower, signaling further downside. Support at 81,513 is now the critical level. If broken, further decline will likely follow.

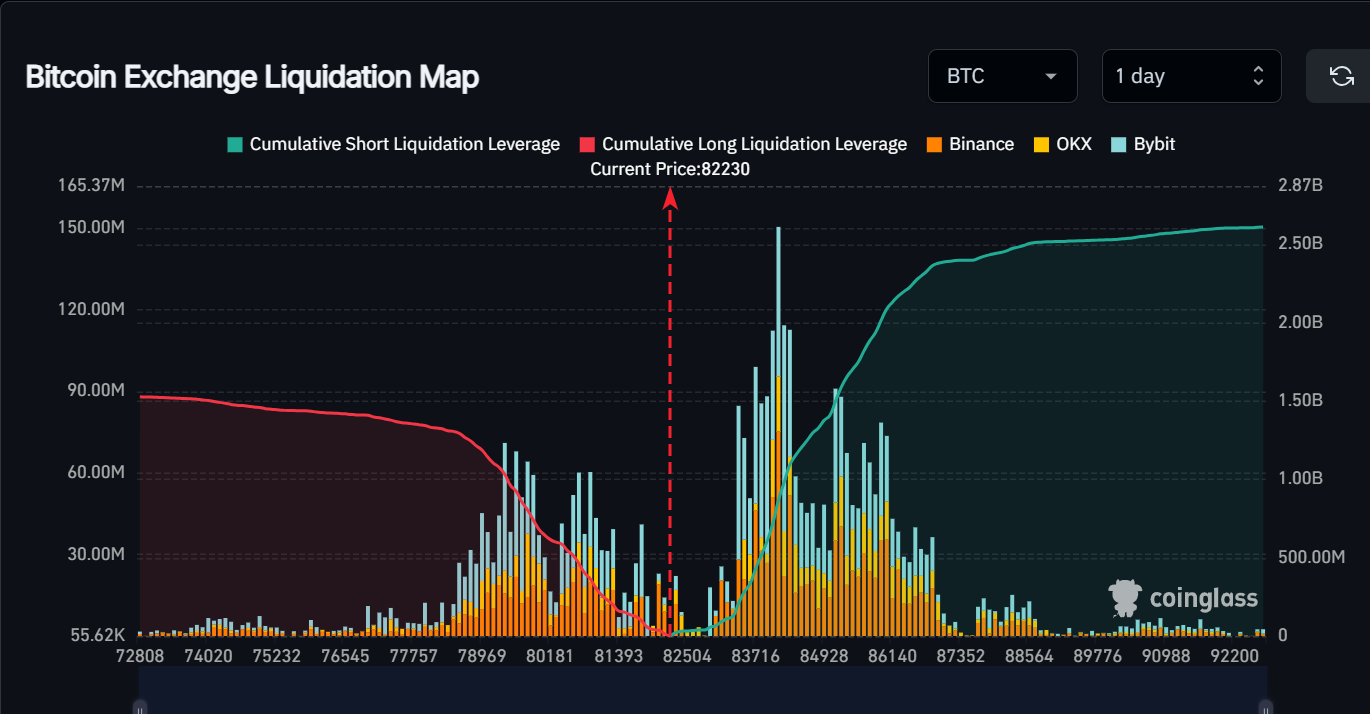

If the price falls below this level, it could cause around $1.3 billion in leveraged long liquidations, according to Coinglass data. Such a massive wipeout will undoubtedly cause strong downward pressure on the price.

Arthur Hayes’s recent analysis may offer insight into what could happen next. In his recent post on X, he said that Bitcoin is likely to retest the $78k level, and if that fails to hold, $75k could be the next target. He added that, a lot of investors have placed options bets around the $70,000-$75,000 price range. “If we get into that range it will be violent,” he remarked.

The Silver Lining

On the bright side, some experts believe that the Bitcoin reserve news is bullish in the long term and that the market’s reaction to the news of it consisting of forfeited BTC (at least in the near future) was the result of inflated expectations. As Matt Hougan, a chief investment officer at Bitwise Asset Management, told CNBC ”The market is short-term disappointed” that the government didn’t say it was immediately going to start acquiring 100,000 or 200,000 bitcoin, he added. Hougan pointed to AI Czar David Sacks’s statement on X, which said that the U.S. would look for “budget-neutral strategies for acquiring additional bitcoin, provided that those strategies have no incremental costs on American taxpayers.”

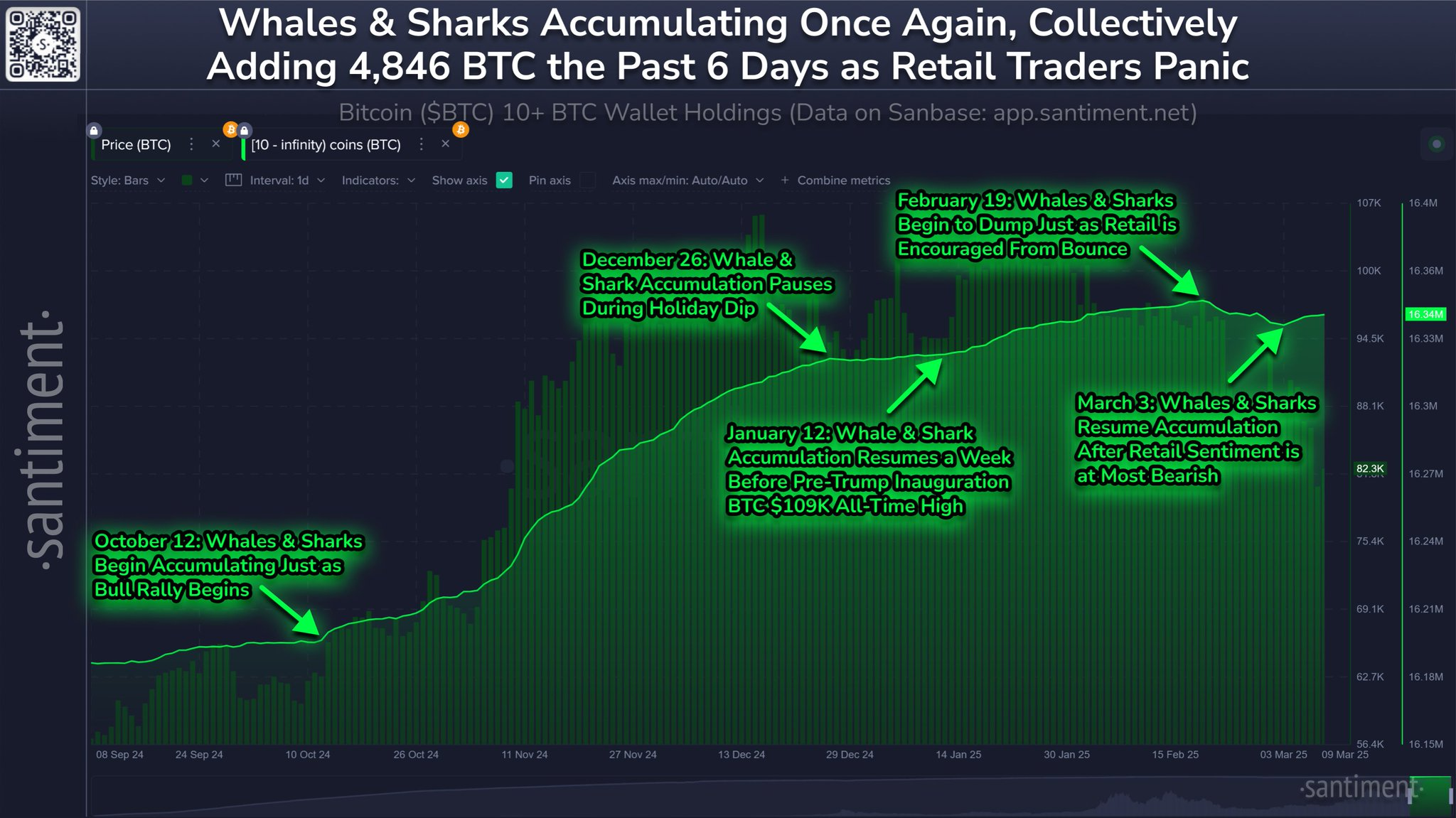

Another positive development (albeit minor compared to the macro headwinds) is that wallets holding over Bitcoin have cumulatively accumulated almost 5000 BCT since March 3, according to Santiment. Although the prices have not yet reflected this, if whales continue to accumulate, the second half of March may be better than the “bloodbath” that market has seen since BTC reached its new $100K peak 7 weeks ago, Santiment analysts said.