Hey there, fellow traders! 🦊 Altie here, your go-to guide from CoinCodeCap, ready to help you snipe 100X meme coins on the SUI blockchain! 🎯🚀

Meme coins are explosive—one moment, they’re worth nothing, and the next, they’re skyrocketing 100X in value. But let’s be real—not every meme coin will make it, and if you don’t act fast, you might miss out on the best opportunities.

Sniping meme coins means getting in early before they hit the mainstream. The earlier you invest in a new meme coin, the greater your potential for massive gains. But it’s also risky, so you need the right tools, strategies, and mindset to do it properly.

That’s why I’ve put together 10 foolproof steps to help you find, analyze, and snipe the best meme coins on SUI before everyone else! 🚀💰

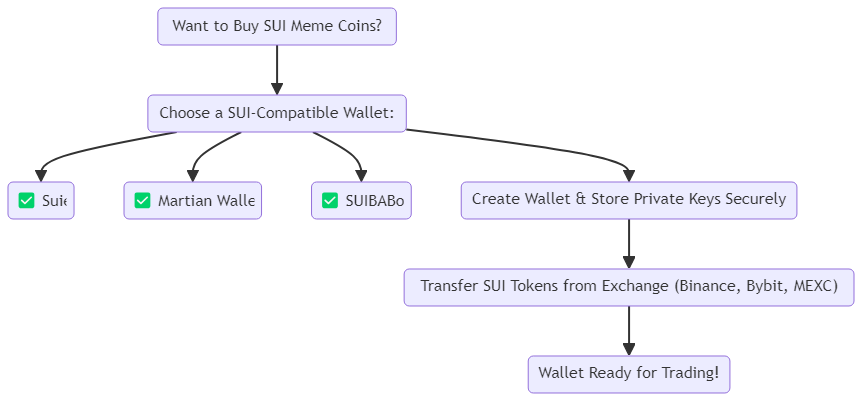

1. Set Up a SUI-Compatible Wallet 🔑

📌 What It Means: Before you can buy any SUI meme coin, you need a crypto wallet that supports the SUI blockchain.

📌 Why It’s Important:

📌 How to Do It:

✔️ Download & set up a bot like SUIBABot, Sui Sniper, or NFD Sui Bot.

✔️ Buy or transfer SUI tokens from Binance, Bybit, or MEXC to your wallet.

✔️ Store your private keys securely—losing them means losing your funds forever!

2. Utilize Sniper Bots for Swift Transactions 🤖

📌 What It Means: Sniper bots are automated trading tools that buy coins the moment they launch, beating manual traders to the punch.

📌 Why It’s Important:

- Meme coin prices can jump 10X within minutes of launch—you need speed!

- A bot automates the process and buys before the general public.

- You don’t have to monitor the market 24/7—the bot does it for you.

📌 How to Use It:

✔️ Set up a sniper bot like SUIBABot or Sui Sniper Bot.

✔️ Configure the bot to buy as soon as liquidity is added.

✔️ Test the bot with small amounts before going all-in.

3. Monitor New Token Listings on SUI-Based DEXs 🛎

📌 What It Means: The earlier you find a meme coin, the bigger your profits. Watching new listings on SUI decentralized exchanges (DEXs) gives you an edge.

📌 Why It’s Important:

- Most 100X meme coins explode within days of launch.

- If you’re late, you might miss the best price.

- The first investors always make the biggest profits.

📌 How to Find New Listings:

✔️ Check DEX platforms like Suiswap, Cetus, and Turbos Finance.

✔️ Use DexScreener to filter for “New Pairs” on SUI.

✔️ Track trending coins—rising buy volume usually signals early hype.

4. Assess Liquidity and Trading Volume 💰

📌 What It Means: Liquidity and volume determine how easy it is to buy and sell a coin.

📌 Why It’s Important:

📌 How to Check It:

✔️ Look at the total liquidity on DexScreener or SUI Explorer.

✔️ Avoid coins with less than $50,000 liquidity—they might be scams.

✔️ Higher volume = more interest in the project.

5. Analyze Transaction Patterns 📊

📌 What It Means: Looking at buy and sell transactions can tell you if a coin is legit or a scam.

📌 Why It’s Important:

- If no one is selling, it could be a honeypot scam (meaning you can’t sell).

- If one wallet owns most of the supply, the dev might dump the price later.

- Healthy trading = real buyers and sellers, not bots.

📌 How to Analyze It:

✔️ Use SUI Explorer to check recent trades.

✔️ Avoid coins where only a few wallets control most of the supply.

✔️ Look for steady buy/sell activity, not just one-sided transactions.

6. Verify Liquidity Locking 🔒

📌 What It Means: Locked liquidity prevents developers from draining the pool and running away with investor funds.

📌 Why It’s Important:

- Unlocked liquidity means the devs can pull the money anytime = scam.

- Locked liquidity shows the team is serious about the project.

📌 How to Verify It:

✔️ Check DexScreener or the project’s website for liquidity lock info.

✔️ Use tools like Team Finance or Mudra Locker to confirm the lock.

7. Engage with the Community 🗣

📌 What It Means: A strong community drives meme coin hype and value.

📌 Why It’s Important:

- No community = no demand = no price growth.

- Real people talking about a coin = good potential for a 100X pump.

📌 How to Check Community Strength:

✔️ Join Telegram, Discord, and Twitter and see if real people are engaging.

✔️ Avoid coins where all the posts are spam or bots.

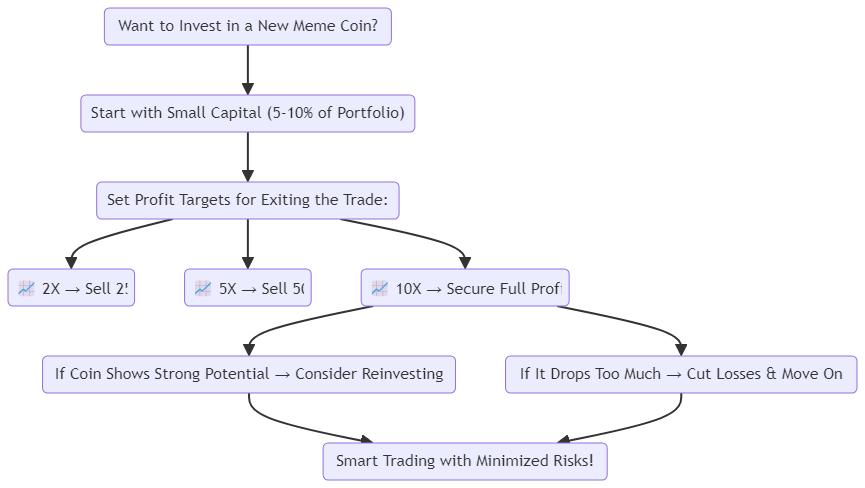

8. Start with Small Investments 🎯

📌 What It Means: Don’t bet everything on one meme coin—start small.

📌 Why It’s Important:

📌 How to Do It:

✔️ Start with 5-10% of your portfolio in new meme coins.

✔️ Take profits at 2X, 5X, and 10X.

9. Stay Informed and Adapt 🔍

📌 What It Means: Crypto changes fast—keep learning to stay ahead.

📌 Why It’s Important:

- New strategies emerge every day.

- Regulations and market trends affect meme coins.

📌 How to Stay Updated:

✔️ Follow crypto news, Twitter, and YouTube influencers.

✔️ Learn new sniping techniques & tools as they evolve.

10. Exercise Caution ⚠️

📌 What It Means: Not every meme coin is safe—be careful of scams.

📌 How to Avoid Scams:

✔️ Avoid projects without clear team info.

✔️ Check if the coin is listed on trusted DEXs.

✔️ If something seems too good to be true, it probably is.

🚀 Final Thoughts – Let’s Snipe Those 100X Gems!

Meme coin sniping is risky but rewarding—if you use the right tools, act fast, and stay informed, you can find and profit from the best SUI meme coins before the rest of the market.

🔥 Key takeaways?

✅ Use sniper bots for speed

✅ Track new listings & liquidity

✅ Analyze transactions & community engagement

✅ Always take profits & manage risk

💡 Now go out there and start sniping! 🚀🦊💰

Until next time—Altie out! 🚀