CoinShares, a major European digital asset manager, recently published a significant report detailing the largest weekly outflows of crypto asset investment products on record.

The data reveals that over $2.9 billion was withdrawn within the past week, pushing the three-week outflow total to $3.8 billion. This marks a sharp contrast to the prior 19-week inflow streak, which had attracted $29 billion into the market.

Bitcoin Leads the Outflows, While Altcoins See Mixed Performance

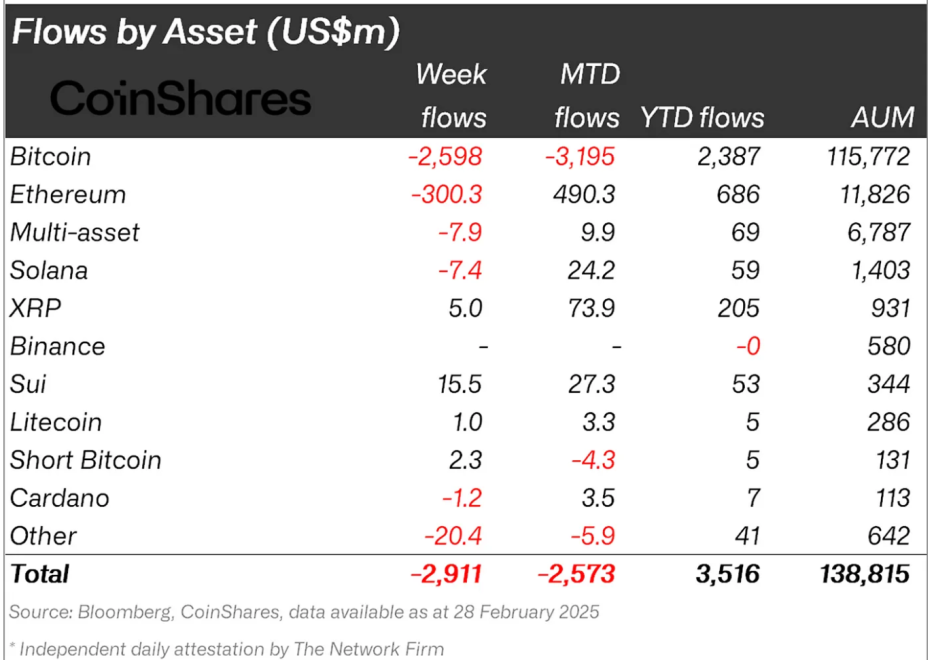

According to the report from CoinShares, Bitcoin bore the brunt of the weakened market sentiment last week, accounting for $2.59 billion of the total outflows.

While short Bitcoin products did see minor inflows of $2.3 million, the overwhelming trend was one of divestment. Ethereum also suffered, recording its highest-ever weekly outflows at $300 million.

Other major altcoins, including Solana and Ton, experienced notable withdrawals of $7.4 million and $22.6 million respectively. Interestingly, amid the largely negative sentiment, a few assets managed to shine.

Sui for instance emerged as the top performer, drawing $15.5 million in inflows, while XRP followed with $5 million in fresh investments.

Despite these exceptions, the overall picture remains one of caution and reduced appetite for digital asset products. Even blockchain equities were not immune, experiencing outflows of $25.3 million during the past week.

Reason Behind The Fund Outflows

According to James Butterfill, Head of Research at CoinShares, several factors contributed to the outflows, including the fallout from the Bybit hack, a more aggressive stance from the Federal Reserve, and the natural profit-taking that tends to occur after sustained inflow periods.

These events combined to dampen sentiment and drive investors to liquidate holdings. Butterfill wrote:

We believe several factors contributed to this trend, including the recent Bybit hack, a more hawkish Federal Reserve, and the preceding 19-week inflow streak totalling US$29bn. These elements likely led to a mix of profit-taking and weakened sentiment toward the asset class.

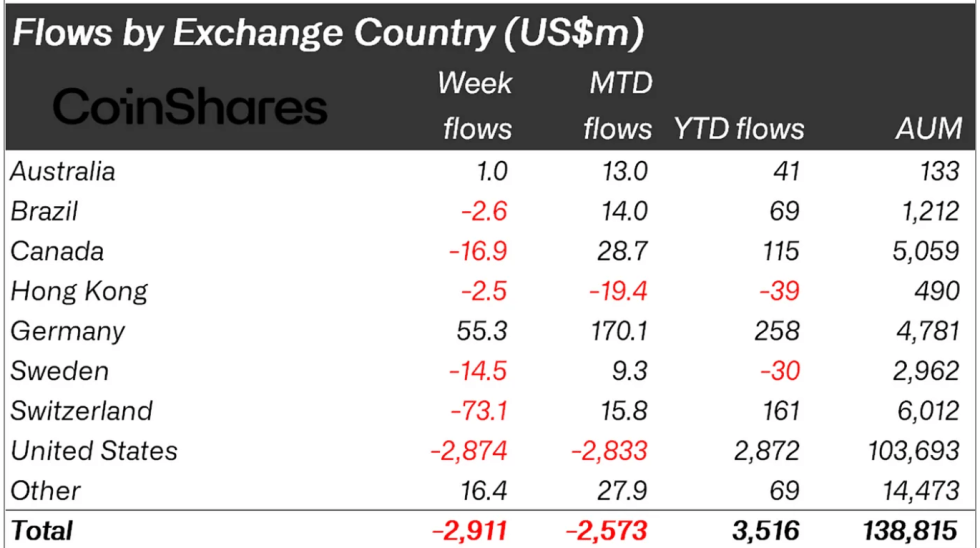

Meanwhile, the outflows were concentrated in several key regions. The United States led the charge with withdrawals of $2.87 billion, followed by Switzerland at $73 million and Canada at $16.9 million.

However, the report did highlight a bright spot: German investors bucked the trend, injecting $55.3 million in fresh capital as they sought to capitalize on the price weakness. This regional divergence highlights the varying approaches investors are taking in response to current market conditions.

Regardless of the outflows seen last week, Bitcoin and the rest of the crypto market has been able to see a noticeable recovery in value. So far, Bitcoin has reclaimed the $90,000 with its current price hovering above $92,000 marking an 8.7% increase in the past day.

This sudden surge from Bitcoin and the overall crypto market can be attributed to the US incoming crypto strategic reserve which was announced yesterday. According to President Donald Trump, this reserve would include BTC, ETH, SOL, XRP, ADA, and other major cryptocurrencies.

Featured image created with DALL-E, Chart from TradingView