This week’s market correction has seen Bitcoin (BTC), the largest cryptocurrency by market capitalization, retest some of its key support levels. As the price starts to recover from the recent lows, some analysts consider the weekend might bring some bullish relief for investors.

Related Reading

Bitcoin Recovers From $78,000 Drop

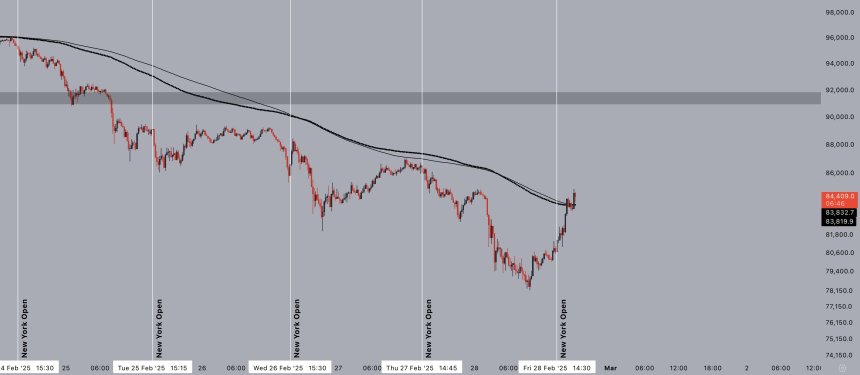

Bitcoin has experienced significant selling pressure over the last week, fueling doubts about a potential market top. The flagship crypto has dropped 21% from last week’s high of $99,000, dipping below the $80,000 level for the first time since November.

The correction also saw BTC drop nearly 30% from its January all-time high (ATH) and trade below its post-US election price range. A week after the market bleeding started, Bitcoin hit a new three-month low, retesting the $78,000 support on Friday morning.

Various market watchers noted that BTC’s most recent decline reached and partially filled its November 2024 CME Gap between $78,000 and $80,700. Rekt Capital pointed out that Bitcoin is experiencing a “strong rebound against the partially filled CME Gap and is doing so on above-average seller volume.”

The flagship crypto has surged around 7% from today’s lows, hovering between the $83,000 and $84,000 support zone for the past few hours.

To the analyst, the CME Gap support and sell-side volume will be two key indicators to pay attention to over the weekend as constant, uninterrupted BTC sell-side pressure is unsustainable, and seller exhaustion potentially accelerates in the next few days.

Bitcoin is finally starting to experience above-average seller volume. There’s still scope for more seller volume to come in, but the chances of Seller Exhaustion occurring are increasing. And Seller Exhaustion tends to precede price reversals.

Is A Weekend Rebound Coming?

Crypto analyst Jelle highlighted that Bitcoin has done “three drives in deeply oversold territory” this week and is retesting the local lows before today’s drop, which suggests that a “weekend relief seems likely.”

The analyst stated that reclaiming the $84,500 support is key for BTC’s recovery as “the past two retests ended up resulting in new lows.”

Nonetheless, he noted that today’s rebound seems different due to BTC “touching the 200-ema cluster” for the first time this week and breaking above it. To Jelle, this could signal an “interesting weekend,” with the new CME Gap at $93,000 open.

Rekt Capital pointed out that Bitcoin “has filled every CME Gap that has formed since mid-March 2024” and that only the newly formed CME Gap between $92,800 and $94,000 remains open after this retrace. If BTC continues this pattern, the price could see a rebound to fill the new gap soon.

Related Reading

The analyst has outlined two potential scenarios for BTC’s current “downside deviation.” According to the post, Bitcoin’s price could revisit $93,500 by the end of the week if the deviation “is to end up as a downside wick.”

Meanwhile, if the deviation is “to end up as the Post-Halving deviation featuring Weekly Candle Closes below the Re-Accumulation range,” BTC’s price could revisit the $93,500 level in the next two to three weeks as “part of a post-breakdown relief rally.”

As of this writing, Bitcoin trades at $85,120, a 0.5% increase in the daily timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com