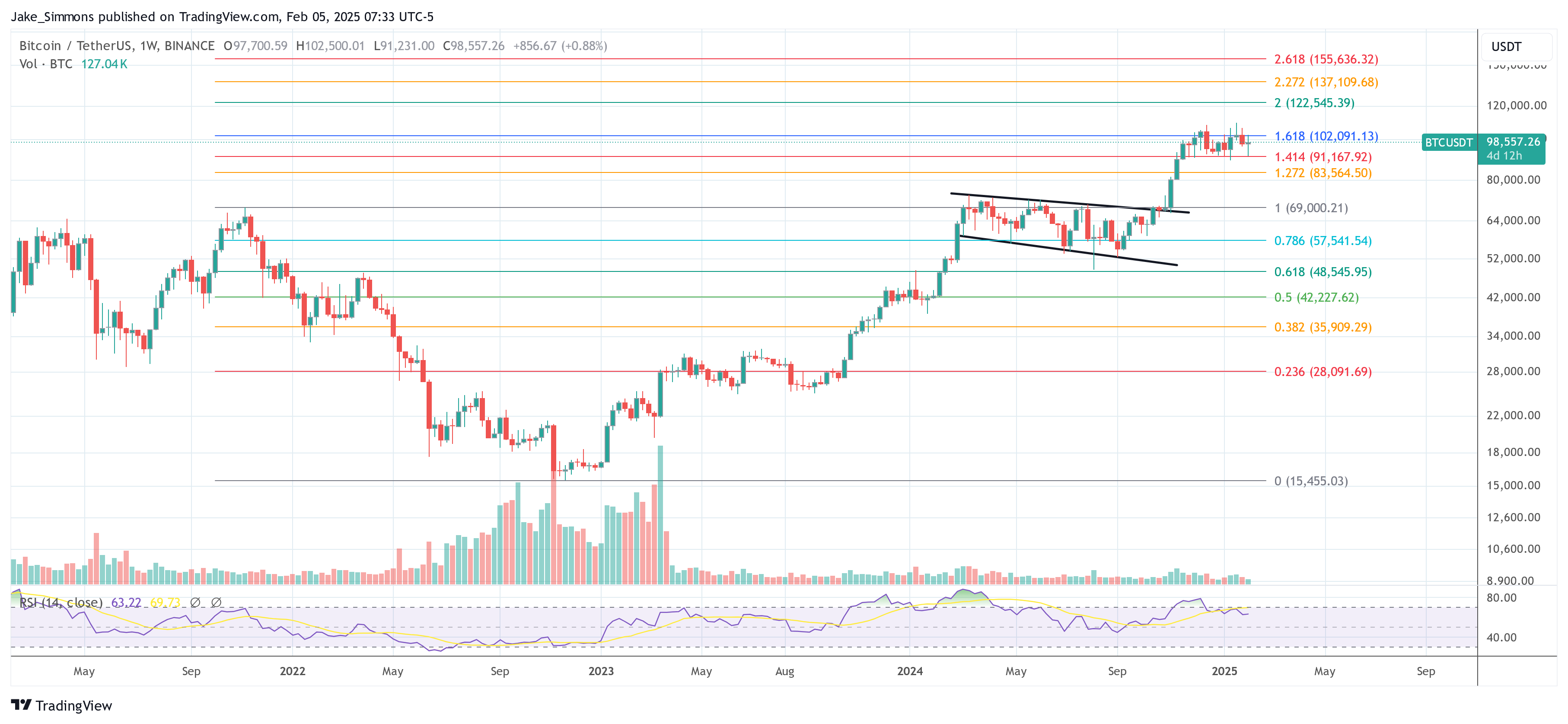

In an escalation of global economic friction, President Trump’s imposed tariffs have roiled financial markets this week, cutting across both equities, Bitcoin and cryptocurrencies. Yet a new memo from Bitwise Asset Management suggests that these headwinds might ultimately propel Bitcoin to new heights—regardless of whether Trump’s strategy succeeds or fails.

At the beginning of the week, the crypto market witnessed a severe sell-off. Bitcoin declined by about 5%, while Ethereum and XRP suffered even sharper losses—17% and 18%, respectively. The immediate catalyst was Trump’s imposition of a 25% tariff on most imports from Canada and Mexico, as well as a 10% tariff on China. In retaliation, those trading partners announced countermeasures of their own.

Related Reading

The US dollar reacted by jumping more than 1% against major currencies. That, combined with lingering weekend illiquidity in crypto markets, triggered a wave of forced liquidations as leveraged traders sold into the downdraft. According to Bitwise Chief Investment Officer Matt Hougan, as much as $10 billion in leveraged positions was wiped out in what he described as “the largest liquidation event in crypto’s history.”

Despite the dramatic price action, Bitwise’s Head of Alpha Strategies, Jeffrey Park, remains optimistic about Bitcoin’s trajectory. He points to two guiding ideas that shape his bullish thesis: the ‘Triffin Dilemma’ and President Trump’s broader aim to restructure America’s trade dynamics.

The Triffin Dilemma highlights the conflict between a currency serving as a global reserve—generating consistent demand and overvaluation—and the need to run persistent trade deficits to supply enough currency abroad. While this status allows the US to borrow cheaply, it also puts sustained pressure on domestic manufacturing and exports.

“Trump wants to get rid of the negatives, but keep the positives,” Park explains, suggesting that tariffs may be a negotiating tool to compel other nations to the table—reminiscent of the 1985 Plaza Accord, which devalued the dollar in coordination with other major economies.

The Two Scenarios: Bitcoin Wins, Fiat Loses

Park argues that Bitcoin stands to benefit under two distinct outcomes of Trump’s current trade policy:

Scenario 1: Trump Succeeds in Weakening the Dollar (While Keeping Rates Low)

If Trump can maneuver a multilateral agreement—akin to a ‘Plaza Accord 2.0’—to reduce the dollar’s overvaluation without boosting long-term interest rates, risk appetite among US investors could surge. In this environment, a non-sovereign asset like Bitcoin, free from capital controls and dilution, would likely attract additional inflows. Meanwhile, other nations grappling with the fallout of a weaker dollar might deploy fiscal and monetary stimulus to support their economies, potentially driving even more capital toward alternative assets like Bitcoin.

Related Reading

“If Trump can bully his way into the position, there’s no asset better positioned than bitcoin. Lower rates will spark the risk appetite of US investors, sending prices high. Abroad, countries will face weakened economies, and will turn to classic economic stimulus to compensate, leading again to higher bitcoin prices,” Park argues.

Scenario 2: A Prolonged Trade War And Massive Money Printing

If Trump fails to secure a broad-based deal and the trade war grinds on, global economic weakness would almost certainly invite extensive monetary stimulus from central banks. Historically, such large-scale liquidity injections have been bullish for Bitcoin, as investors seek deflationary and decentralized assets insulated from central bank policies

“And what if he fails? What if, instead, we get a sustained tariff war? Our high-conviction view is the resulting economic weakness will lead to money printing on a scale larger than we’ve ever seen. And historically, such stimulus has been extraordinarily good for bitcoin,” Park says..

At press time, BTC traded at $98,557.

Featured image created with DALL.E, chart from TradingView.com