DeepSeek, a Chinese startup, launched its latest AI model, competing with industry-leading Large Language Models in the U.S. at a fraction of the cost, disrupting Bitcoin, crypto and the AI agent economy.

The apps roll-out on the Apple App Store over the weekend saw users rush to download the application, driving its popularity and ushering a correction in Bitcoin and AI agent tokens on Monday. The AI model’s launch wiped out $2.5 billion from agent tokens.

Bitcoin (BTC), altcoins and crypto tokens are attempting to recover from the shockwaves sent by DeepSeek, BTC trades above $102,000 on Tuesday.

Bitcoin and AI agent token market overhauled by DeepSeek

Crypto market capitalization holds steady above $3.649 trillion on Tuesday. The market cap of AI agent tokens suffered another 12% correction in the last 24 hours, down to $10.125 billion, according to CoinGecko data.

The top three tokens in the category, Artificial Superintelligence Alliance (FET), Virtuals Protocol (VIRTUAL) and ai16z (AI16Z) were hit by double-digit declines in the past seven days, between 4 to 7% correction in the last 24 hours.

The three tokens have started their recovery in the past hour as crypto traders digest the future outlook of AI and technology dominance in China.

The AI market cap slipped from $12.9 billion to $10.2 billion on Monday as the Chinese LLM promised 14 cents per million tokens against GPT-4’s $15. U.S.-based crypto traders are concerned about a widespread market correction as the technological update challenges the U.S.’s $500 billion Project Stargate initiative.

The Venice Token (VVV) project debuted its AI-focused token distribution and hit $1 billion in valuation within 2 hours of the airdrop. 25% of the project’s genesis supply is allocated to protocol accounts on the Base blockchain.

The VVV token is trading at $13.23 with a market cap of $304.16 million on Tuesday. Traders can claim their airdrop until March 2025.

While DeepSeek-V3 competes with rival ChatGPT and shakes down U.S. equities and tech stocks, it emerges as a key market mover for Bitcoin.

Derivatives data shows crypto traders knee-jerk response to China’s AI future

NVIDIA’s crash pushed Bitcoin futures premiums on CME to negative territory for the first time since August 2023. BTC open interest declined by 17,225 BTC, the largest daily decline.

Analysts at K33 Research estimate that the decline in OI was driven by active market participants who reduced their exposure by 14,875 BTC tokens. Data shows that January contracts expiring on Friday could push OI lower.

Though premiums may have returned to slightly positive territory, CME activity is a clear indicator of bearish sentiment among derivatives traders and favors caution this week.

Bitcoin’s Monday decline could be considered noise on the longer timeframe, however the aggressive derisking on CME fuels a narrative of caution among traders as BTC premium slipped into the negative territory for the first time.

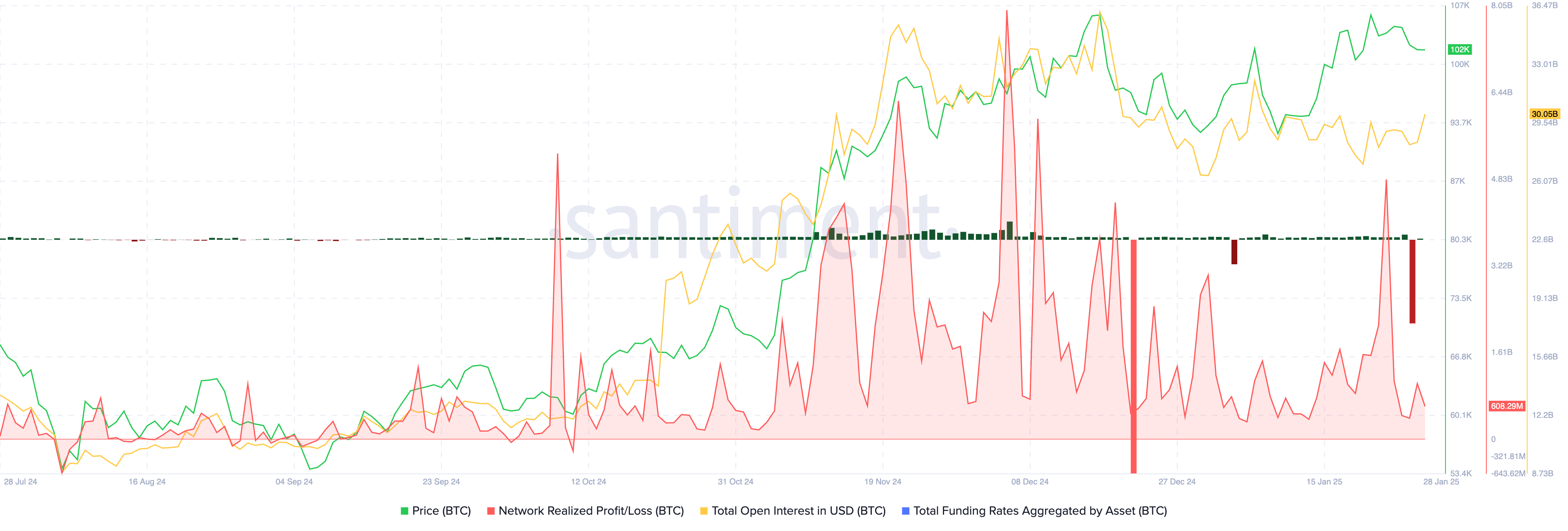

On-chain data from Santiment shows that Bitcoin traders de-risked promptly, with over $1 billion in profits realized on BTC holdings on Monday. The total OI in Bitcoin has recovered since then, and the total funding rate aggregated by asset is back in positive territory, as seen in the chart below.

Bitcoin suffers from a strong correlation to U.S. equities

Bitcoin and U.S. equities have enjoyed a relatively strong correlation in the current quarter, and this remains one of the most reliable market dynamics for traders in Q1 2025. Bitfinex analysts identified the 30-day rolling Pearson correlation between Bitcoin, the S&P 500, and the NASDAQ as 0.7.

The numbers are coincidental but likely an indicator of traders treating BTC as a risk-on asset, moving in lockstep with traditional equities. Over the course of last week, Bitcoin options implied volatility reduced by 13%. It can be interpreted as traders expecting no major movements in BTC price this week.

Bitcoin traders keep their eyes peeled for the U.S. Federal Reserve’s interest rate decision this week. Considering the impact of the previous FOMC meeting, the sentiment has shifted towards derisking ahead of the announcement, traders can gear for a decline in BTC price prior to the announcement.

Bitcoin price has noted heightened volatility within the first 20-30 minutes post U.S. macro releases since the beginning of the bull run in 2024.

DeepSeek’s launch impacted NVIDIA negatively, and BTC was not immune to the event. DeepSeek therefore eclipsed the “Trump effect” on Bitcoin, even as traders await updates on the national Bitcoin stockpile and strategic reserve, events in tech and AI continue to jolt BTC and altcoins, alongside equities.

Top 5 altcoins to watch during the shifting AI and tech tide

Data from SoSoValue, an AI-powered crypto investment platform, shows that the DeFAI and AI agents category has corrected the most in response to DeepSeek’s arrival in the U.S. market.

The DeFAI sector’s market cap corrected 28.73% in 24 hours. The top four tokens in the sector suffered double-digit corrections, over 20%. Among DeFAI tokens, Griffain (GRIFFAIN), Orbit (GRIFT), Hive AI (BUZZ) and Neur.sh (NEUR) noted steep corrections on Monday; the tokens have started their recovery in the past 24 hours.

In the AI agents category, leading projects such as Fartcoin and mainstream AI tokens, ai16z, AIXBT, and AI Rig Complex were corrected in double-digits.

The meme coin sector was not immune to DeepSeek’s release and suffered over 8% decline in its market capitalization within a 24 hour timeframe. Pepe (PEPE) observed the steepest correction in the top meme coins, down by 11.33% on Monday, offering sidelined buyers an opportunity to buy the dip.

Layer 1 tokens suffered the least among other categories, and tokens like Jupiter (JUP) and Onyxcoin bucked the trend, emerging as key altcoins to add to a portfolio to tackle similar events in the future.

Expert insights on AI market trends, crypto portfolios

Jawad Ashraf, CEO of Vanar, a decentralized Layer 1 blockchain focused on RWA adoption, believes crypto’s short history and frequent “regime shifts” offer limited data to train predictive AI models for portfolio management. Commenting on the use of AI in crypto portfolio management, Ashraf told Crypto.news:

“Geopolitical wildcards compound the challenge, introducing unexpected market conditions that AI can’t easily anticipate, making human oversight and risk management essential.”

Discussing Trump’s executive orders and actions in crypto, Ashraf said:

“Despite no major executive actions on crypto in Trump’s first 100 orders, the administration’s openness to digital assets was hinted at when both Trump and Melania dabbled in meme coins—blurring lines between personal ventures and government influence. Combined with a strong “America First” attitude toward tech, this can accelerate a “Wild West” environment if certain tokens receive overt government endorsement or implicit backing.”

Ashraf believes U.S. based AI and crypto projects could benefit from a more favorable policy stance on the sector, and foreign initiatives could face headwinds in adoption. Alvin Kan, COO of Bitget Wallets told Crypto.news in an exclusive interview:

“The Trump administration is expected to promote AI innovation by reducing regulatory constraints, potentially boosting AI tokens and the broader AI sector. The repeal of Biden’s AI executive order might shift focus from ethical considerations to rapid development, influencing market dynamics. Industry sentiment is mixed, with optimism for growth but concerns about oversight and ethical AI use.”

The rivalry between Huawei and NVIDIA is fueling a high-stakes “arms race” in AI hardware — driving down costs and encouraging faster innovation. Meanwhile, new entrants from other major tech giants are racing to release specialized chips, widening the competitive field. On one side, NVIDIA remains the global GPU market leader; on the other, Huawei benefits from strong domestic support within China, potentially giving it a leg up in certain markets. This competitive push should accelerate Gen AI’s expansion across industries, including blockchain applications. However, geopolitical tensions and supply-chain uncertainties — amplified by the U.S.-China tech rivalry — could temper how quickly these benefits reach the broader market.

Discussing the Huawei and NVIDIA rivalry, Ashraf cites the example of an “arms race.” According to the Vanar CEO:

“The rivalry between Huawei and NVIDIA is fueling a high-stakes “arms race” in AI hardware—driving down costs and encouraging faster innovation…On one side, NVIDIA remains the global GPU market leader; on the other, Huawei benefits from strong domestic support within China, potentially giving it a leg up in certain markets.”

The competition between the two giants continues to weigh heavily on Bitcoin and crypto, given the impact of AI-related developments on the sector.

Noting the massive correction in the AI agent category amidst their rising relevance this week, Ashraf predicts rapid evolution in architecture and possible integration with LLMs, making the current agent designs obsolete. For traders and investors, Ashraf’s advice is to:

“Distinguish between short-term hype and genuine utility: scrutinize the underlying tech, project roadmaps, and real-world partnerships. Portfolio-wise, small, diversified positions can be prudent, while keeping an eye on the sector’s broader evolution toward more advanced AI-driven networks.”

Bitget Wallet COO Kan believes that the AI agents sector could continue to expand in the first half of 2025, potentially reaching a market capitalization of $20 to $25 billion. Kan warns traders,

“…However, there’s a risk of market correction which could see the cap drop to around $12B if growth was largely speculative. The actual outcome will hinge on broader market trends, regulatory developments, and real-world adoption of AI agents.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.